It’s relatively a new month and a great time to find new investments. Hopefully by now you’ve had a chance to check out a private investing opportunity from our partner in the Boardroom by now. The platform simplifies the process for finding quality information on private markets, which has traditionally been a tough putt for individual investors. Here’s more of that story from the Boardroom.

Welcome to May, and I hope you were able to bear the barrage of horrible Star Wars jokes on Thursday – luckily I do so by avoiding Facebook 🤣

But, speaking of fantasy…🧙🪄

Imagine a world where equity analysts were straightforward and gave their honest opinions about the company they cover. A world where ratings were as simple as “Buy” and “Don’t Buy” rather than a bunch of nonsense like “Outperform.” My favorite move is when a company misses estimates, gets hammered in the market, then the analysts respond by lowering their price targets. Why doesn’t their analysis ever seem to pick up on these things beforehand?

If research on public companies isn’t great, then surely private company research is nonexistent right?

Wrong!

The folks at KingsCrowd recognized the dearth of information available to individual investors in the private markets so they built the platform that is democratizing access to high quality actionable data.

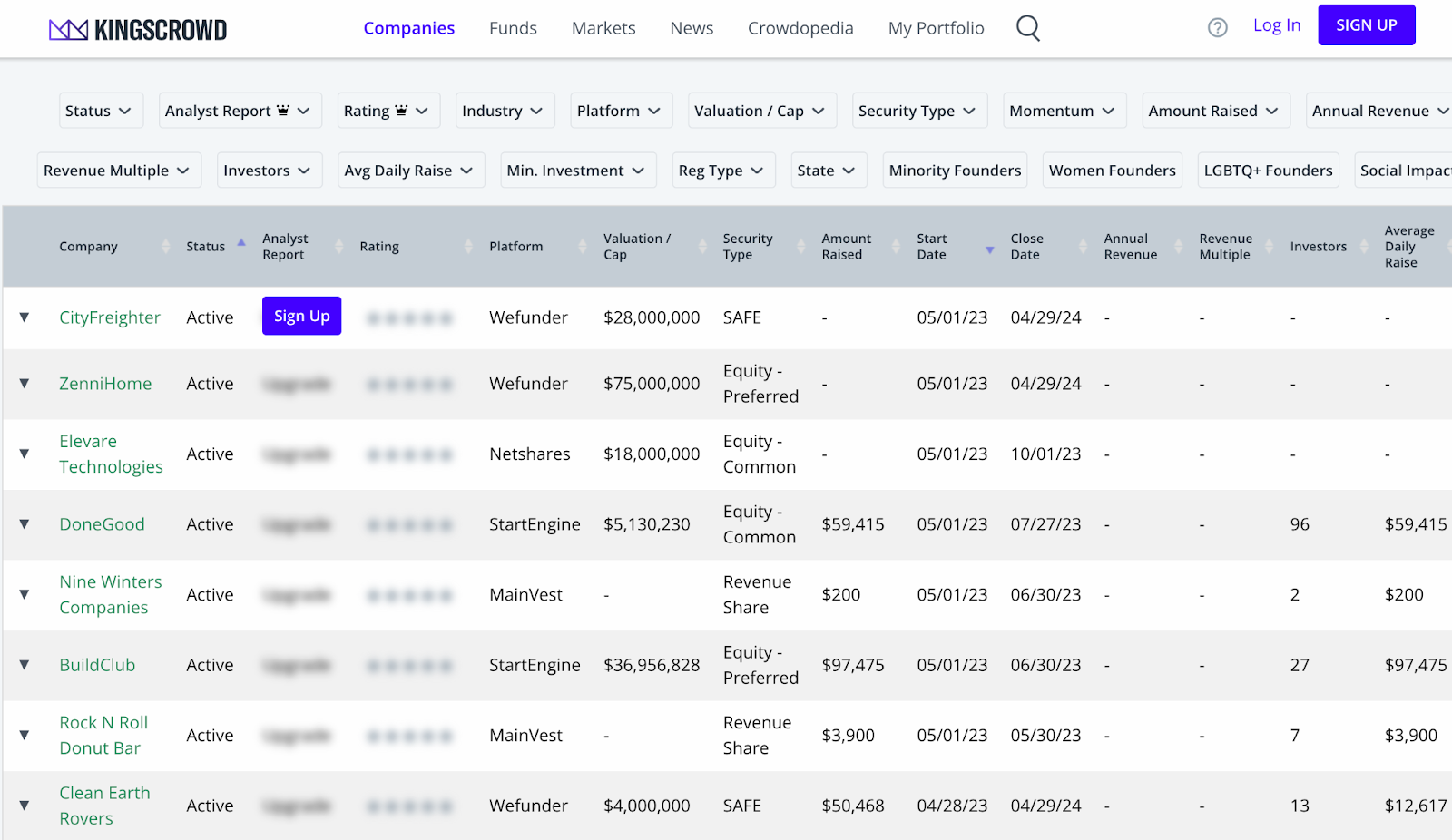

What would previously take an investor hours and hours to do surfing through the various crowdfunding sites now can be done in just minutes using the KingsCrowd tool suite, and thanks to their proprietary rating methodology, investors can instantly get a list of the companies most likely to become long term winners. Its data looks like this:

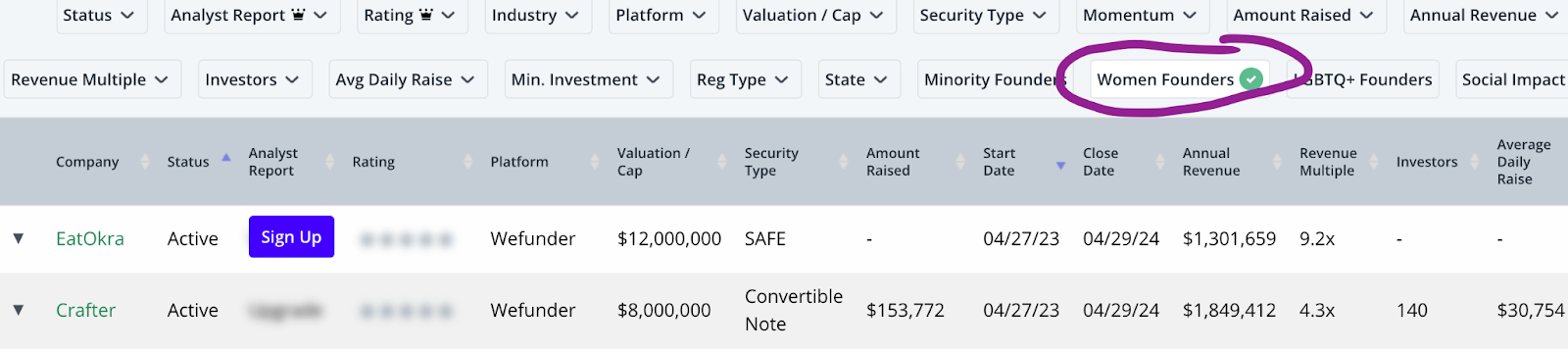

And if you didn’t notice the top of that webpage👆, you can quickly sift through mountains of data based on rating, industry, geography, women owned, and other drivers to find a tailored list of companies to dive into. Check that out 👇:

Even if you aren’t ready to pull the trigger on a particular investment, the tool allows you to build a portfolio of companies to track so you can test your analysis and track performance before committing capital, dipping your toes in the private market waters.

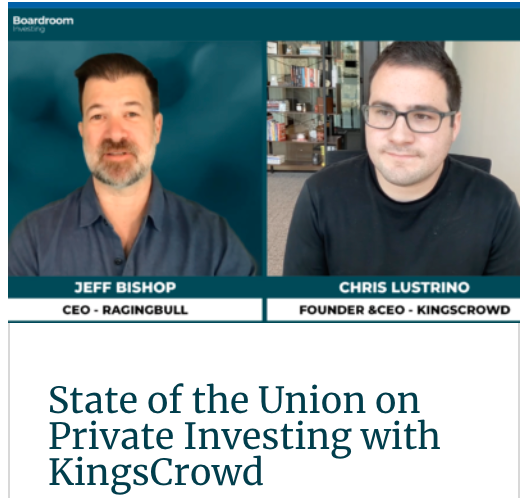

You might remember a few weeks back when we spoke with Chris Lustrino, founder and CEO of KingsCrowd on the history of the company, and how his background in private equity led him to build a solution for an underserved market.

If you haven’t seen it yet, or just need a refresher, Here is the interview which introduced us to KingsCrowd, and be on the lookout as we are trying to get Chris back for a second sit-down with us some time in later this month.

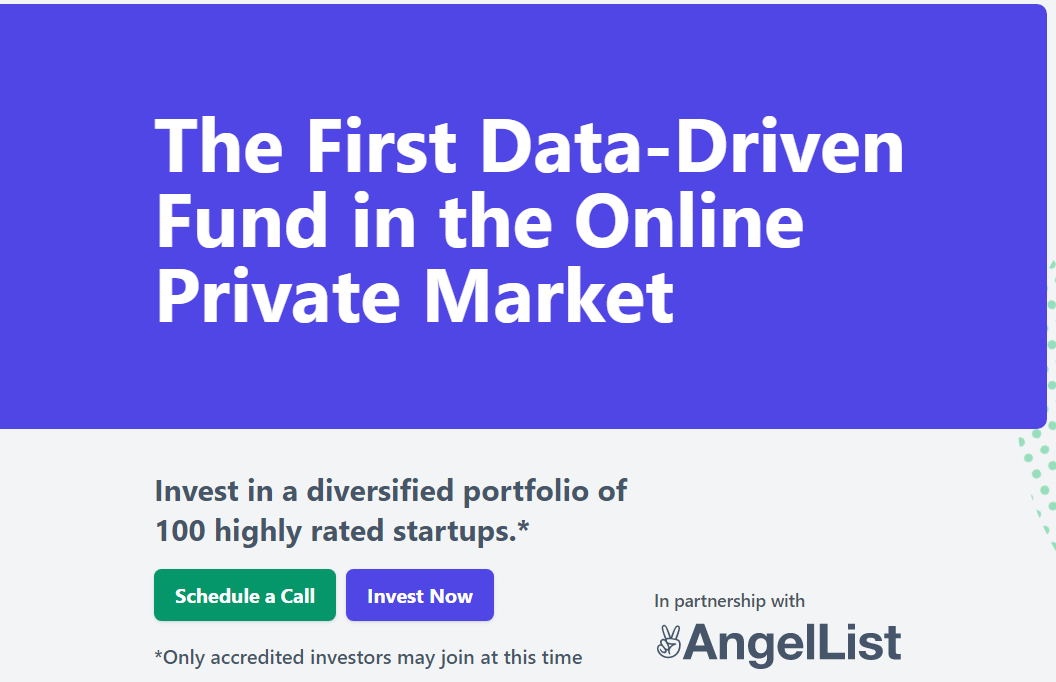

The KingsCrowd platform can not only help investors who take an active approach to finding portfolio companies, but those who prefer a passive style as well.

⭐The company manages a fund consisting of 100 startups that it has rated highly through its internal research, giving investors a diversified way to own a group of high growth companies in the early innings.

As of now the fund is open accredited investors so check it out if you meet the qualifications and are looking for a data driven way to get into startups.

So to simplify the opportunities with KC:

- You can become a user of their services to research your own private investing opportunities

- You can Invest in KC’s FUND of private investments

- You can also invest in KingsCrowd itself as a private investor

To this third point, Kingscrowd is in the middle of its own Reg A offering with shares currently priced at $1.00 each and a minimum investment of $1,000. Check out the offering here.

There really is nothing like out there in the private investing space, with so many unique opportunities Chris Lustrino and his team at KingsCrowd are pursuing.

So I encourage you to check all the details out HERE while this offering is still open.

|

|||

|

|||

|

|||

|