*Sponsored by

![]()

Recapping this week, we’ve had some great events, taught our butts off as usual, and navigated some crazy swings in the Market no thanks to bananas banking news…

With that being said, The Boardroom welcomed its newest partner on Monday – CEO & Founder Chris Lustrino of KingsCrowd – in true webinar fashion which can be revisited HERE…

💥And this interview could not have happened at a more opportune moment.💥

KingsCrowd is really the only game in town when it comes to comprehensive data and reports on all CF deals out there. That has big upside in my opinion since the data they are gathering has huge long-term value and there are no other true competitors.

And, as CEO of a company that has a chokehold on the private investing research space, Chris has a unique perspective on how things really look for private companies after the SVB banking debacle we saw over the last week.

Chris had some great insights about how the future of crowdfunding is going to look.

Simply put, he thinks the best companies out there (the ones his company rates 4-5 stars ⭐) should be just fine. There is a lot of appetite to invest in the strongest companies out there, just like the stock market.

Those that are poorly rated or that don’t have good business models? Well, they are going to have a very tough time surviving in the new world where money is harder to raise. It truly is…

Survival of the fittest – both with private companies and public ones.

There were a lot of really great interview highlights including the “provenness” of the company as well as its multiple revenue streams, so I encourage you to watch the full interview. But in the meantime:

1. If you are interested in checking out the services of KingsCrowd for your OWN investing decisions, head on over to their website HERE…

2. If you are interested in investing in the company itself as it is conducting a current RAISE, click here to learn more about what this looks like HERE…

OR…

3. Grab your beverage of choice, kick your feet up, put those blue light glasses on and keep reading below…as we have attached key excerpts from Alts.co’s recent KC Deep Dive 🤿.

To Your Success 🍻,

Jeff Bishop

——————————————————————————————————————————————————————————————-

Today we’re looking at KingsCrowd, a platform that analyzes startups that are fundraising and finds “diamonds in the rough.”

Since venture capital dried up last year, many startups have opted to crowdfund instead. But not all of these companies are created equal. Not even close.

This is where KingsCrowd comes in. These guys take data from popular crowdfunding sites (Republic, WeFunder, etc.) and rank each company using a proprietary score.

They’re off to a terrific start, and now they’re raising money themselves (so meta).

Let’s go

The problem with startup investing

Ten years ago, most alternative investing opportunities were restricted to accredited investors (i.e. just 10% of all Americans). Then the JOBS Act changed everything.

But while getting accessibility to startups is great, it has its challenges.

For starters, sifting through thousands of investment opportunities is a grind. And secondly, startups are notoriously risky:

- Just 22% of all startups meet their crowdfunding goal

- Under 10% of companies raising via a Seed Round make it to Series A funding

- 66% of startups never deliver a positive return to their investors

Transparency issues also add to the risk. Because crowdfunding is so easy now, many companies are doing deals with terrible financials, bloated valuations, and questionable business models. Without doing proper due diligence, investors can get screwed pretty easily.

But how do you perform DD on crowdfunding startups? Where’s the transparency? Where’s the data?

Enter KingsCrowd.

What is KingsCrowd?

KingsCrowd is a data platform capitalizing on the $13 trillion alternative assets industry.

They provide due diligence on startups. Hundreds of startup opportunities across the crowdfunding landscape.

But the strongest feature is their proprietary ranking system. Read more about their startup rating methodology.

Founder’s story

Chris Lustrino, KingsCrowd’s founder and CEO, started his journey in private equity in 2014. He was a manager and consultant for some big private equity clients (sorry, I can’t say which ones).

Chris started his original blog covering everything in the alts industry. He hosted CEOs from big platforms like Republic, WeFunder, Fundrise, and so on.

KingsCrowd CEO Chris Lustrino founded the company after getting fed up with the lack of transparency in the private equity industry.

In 2018, Chris was contacted by John Fanning — Founding Chairman and CEO of Napster (yep, that Napster). Fanning offered Chris the chance to build a company together. And with that, KingsCrowd was born.

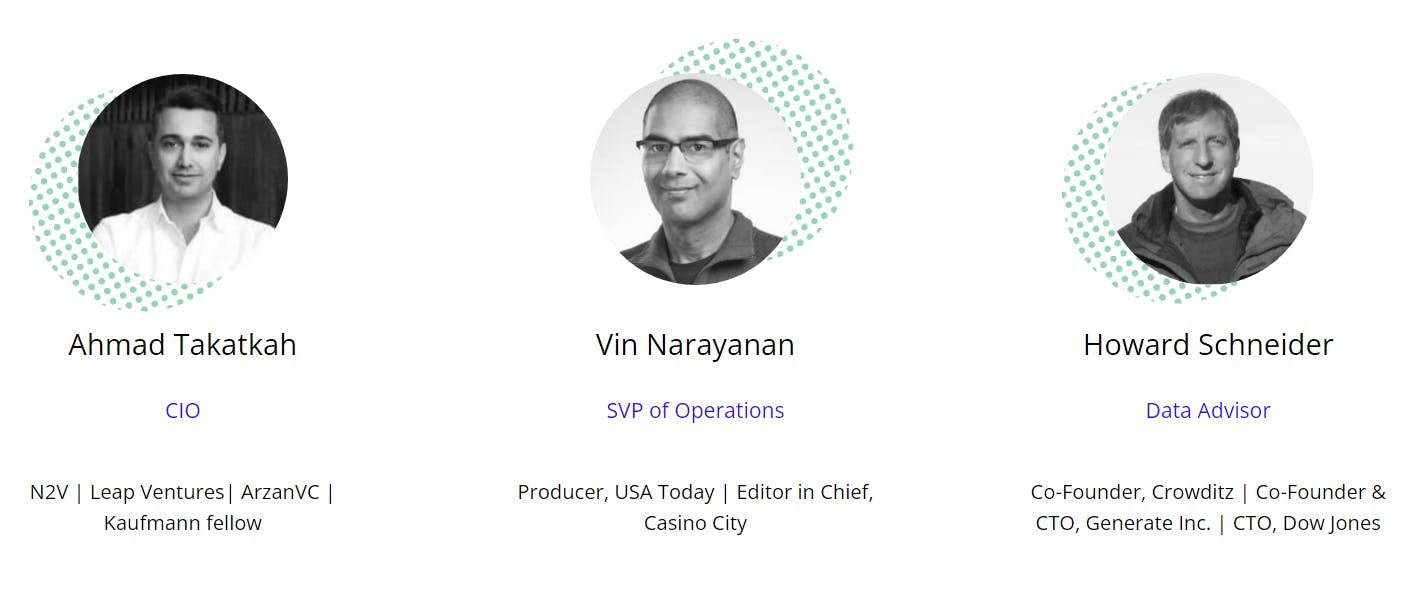

The team

KingsCrowd has 6 key employees from across the alts industry, and 5 advisors. The company has raised money from more than 40k different investors since its inception five years ago.

KingsCrowd’s advisor team includes the former CTO of Dow Jones.

How does KingsCrowd work?

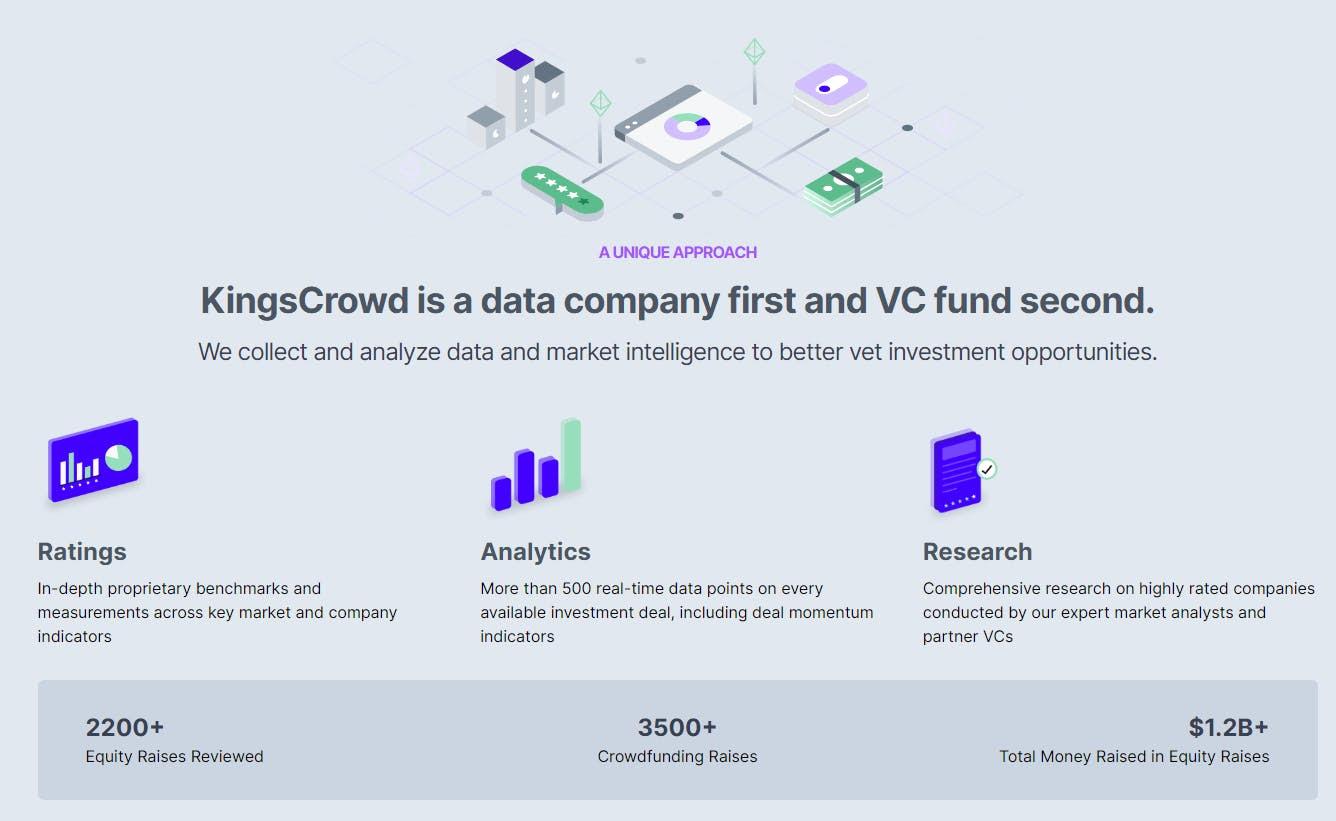

KingsCrowd is, at heart, a data company.

The team scrapes and manually collects data from hundreds of platforms. They present it in three ways:

1) Database Search

Finding the perfect startup investment can be a painstakingly long process. But with KingsCrowd you can narrow the search in minutes.

The search feature works based on filters – and there are heaps of them:

- Market/cap valuation

- Security type

- Annual revenue

- Country, state, city

- Minority/female founders

- Social impact

Want to invest in a female-led company with a small market cap? Or a Georgia-based media company valued under $10m? Easy.

Andrea Peterson, Co-Founder and CEO of real estate company School of Whales. One of many female founders you can find on KingsCrowd.

Another neat feature: You can sort deals by trending to browse the most popular startup opportunities at any given time. Wisdom of the crowd and all that.

2) Due Diligence

Okay, but there are lots of startup databases, right? Crunchbase, CB Insights, Owler, etc. But while these databases are valuable, they don’t offer due diligence. And this is the best feature of KingsCrowd.

Some of you may know that in a previous life I was Head of Product at Flippa, where I started their first due diligence program.

Providing due diligence on deals is extremely important, and was a massive impetus for starting KingsCrowd. The team emphasizes accurate and digestible info.

KingsCrowd crunches 300+ data points from companies raising capital (including revenue, valuation, market opportunity, and past performance) and gives them a proprietary score.

Additionally, 15-20% of deals on the site get their own deep dive — a more in-depth report for those companies that warrant one.

KingsCrowd shows you what’s really going on with startups raising money. It uses scraped data, proprietary scoring, and crowdsourced data (like the bullish vs bearish sentiment feature on the right)

But again, the rating system is what really sets KingsCrowd apart.

I’ve analyzed dozens of startups which KC has rated both highly and poorly, and the system is terrific.

In fact, we here at Alts will begin using KingsCrowd ratings in our own Deep Dives.

Coming soon to an Alts Deep Dive near you.

3) Management

The average KingsCrowd investor has 17 different investments in their portfolios and rising.

Managing a diverse portfolio across several marketplaces is tiresome. But when you use KingsCrowd, you can track them all within your account.

Just add in your investment details and the platform will follow key metrics whenever the info becomes available, including:

- Valuation trackers

- Portfolio value

- IPO notifications

- Exit sale notifications

- If a company is going out of business

This is Galiano Tiramani, founder of Boxabl, the highest-valued company on KingsCrowd at time of writing. I’d be grinning too if my company was worth $3.4b.

KingsCrowd Capital Fund I

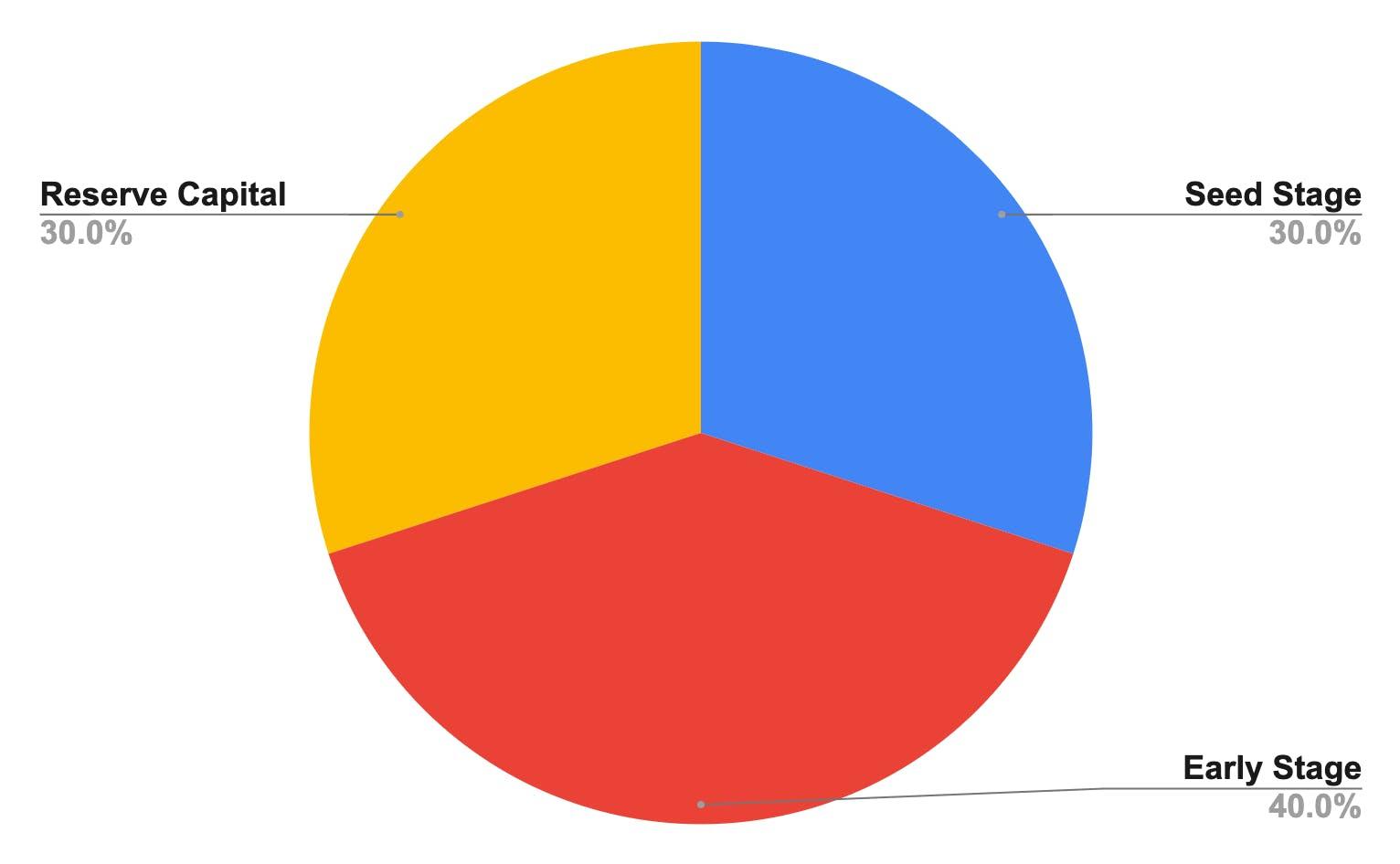

KingsCrowd is continuously building new features and ventures. In fact, they just launched Capital Fund I, what they call “the first data-driven fund in the online private market.”

The KingsCrowd Capital Fund 1 comprises 100 highly-rated startups based on KingsCrowd’s proprietary rating system.

The fund received $1m from investors within a few days of its release, and funds are being distributed across diverse companies at different stages:

- 30% spread among 60 Seed Stage companies

- 40% spread among 40 Early Stage companies

- 30% in Reserve Capital to double down on 6-12 winning investments

Think of KingsCrowd Capital 1 Fund as a “best of the best” of what they see on the platform.

Capital Fund 1 Details

- Size: $10m

- Term: 10 Years

- Type: Limited partnership

- Fees: 1% management, 10% carry

- Investment minimum: 20k

- Accreditation: Accredited investors only

This isn’t the main investment opportunity we’re exploring today, but you can schedule a call with the KingsCrowd team to learn more.

Who uses KingsCrowd?

KingsCrowd’s primary user is 33-55 years old, on a salary of $100K+. It’s about 70/30 male to female, though the team is looking at ways to drive female engagement.

However, when I spoke with Chris, he mentioned a couple of new user types that piqued my interest.

Founders

More and more founders are creating KingsCrowd accounts to utilize the data sets available. The information can help them determine their valuation, how much their raise should target, how long it might take to raise, and various other metrics that can improve their success rate.

Alts industry employees

Employees from alternative investing platforms are starting to use KingsCrowd too. These guys might be trying to understand their company’s market share, the quality of their deal flow according to KingsCrowd’s ratings, and how they can build on their audience.

KingsCrowd wants to harness these two demographics by building tools unique to their situations. For example, they could implement a feature that automatically calculates how much a company should target in a raise based on the data of similar companies.

Potential developments like this speak to the versatility of KingsCrowd’s product — it can appeal to so many different people tangentially connected to the space.

Other cool features

A few other things I like:

- Customizable data on market activity, including valuation trends, raise activity

- Weekly funding reports and crowdfunding news and analysis

- A blog (where it all began!), podcasts, and investor interviews

I’ve been enjoying receiving the KingsCrowd newsletter in my inbox each week.

How to invest in KingsCrowd

KingsCrowd is raising money through a Reg A offering. You can access the opportunity directly via KingsCrowd’s platform.

The team has already raised $7m from major institutions and 4,000+ users within their community.

Investment type

- As an investor, you would be buying Class A Common Stock. These are the most common form of shares and often give investors the right to a portion of the company’s earnings.

- However, KingsCrowd plans to reinvest earnings rather than provide distributions. Shareholders will receive voting rights.

- Each share is valued at $1. There is a maximum of 15m shares available.

Previous raises

KingsCrowd raised money between 2018-20, issuing 8.7m shares at an effective cash price of $0.13 per share.

Investors in the current raise will receive an immediate dilution of net tangible book value.

KingsCrowd has never achieved profitability. However, its revenue has increased substantially since being founded in 2018.

The KingsCrowd community also contains active investors (“investomers“, as they call them). When the team launched their KingsCrowd Capital Fund, they received $1m+ from these customers within days, thanks to their deep level of trust for the company.

Fundraising goals

A significant percentage of the proceeds will go toward marketing.

Most of KingsCrowd’s revenue comes from user subscriptions, so expanding its customer base is a hugely important step towards profitability.

For example, the team will implement a referral system to incentivize existing users to onboard friends and family.

Product growth will also be a core focus for the raise. KingsCrowd wants to continue enhancing its rating algorithm and develop products targeting early and late-stage founders using the platform.

User experience will also get a revamp. The team is working on new features to improve the customer experience

- Overhauling the UX (I think it’s pretty good already)

- More portfolio management tools (great)

- Push notifications for investor updates and relevant company news (love it)

Holding period

There is no secondary market for the shares, Investors will have to wait for an exit.

Like with any startup, be prepared to wait 5+ years for this.

Who can invest?

Both accredited and non-accredited investors can get involved in the KingsCrowd raise.

Residents from the United States are welcome. But investors from other nations are restricted, unfortunately.

How does KingsCrowd stack up?

Liquidity

Not the best

KingsCrowd is distributing Common A Shares, giving them more flexibility than other private deals. But this type of deal isn’t known for having great liquidity — and you may be waiting half a decade or more before seeing a return.

Returns potential

Excellent

While I don’t know how big their moat is, KingsCrowd is off to a great start and doesn’t have a lot of direct competition.

An exciting possibility is becoming the Morningstar/Bloomberg of the alts industry. And obviously we are biased, but as alternative assets continue striding toward the mainstream, there are potential syndication and buyout opportunities with platforms like Robinhood.

Platform & product

Unique and valuable

KingsCrowd’s rating system is reliable and boasts some pretty impressive stats.

98% of highly-scored startups successfully make it to the next round of funding. And highly-scored raises averaged unrealized returns of 3.5x.

Simply put, their algorithm kicks ass — and they’re just weeks away from officially patenting it.

Usability

Perfectly fine

I know they are putting some muscle into UX, but I find navigating the KingsCrowd site a good experience.

Everything is clean, easy to find, and functional enough. The only slight issue is the homepage can be slow to load on Chrome.

Team

Solid

Chris has hung around the private equity industry for a decade, and his blog was well-received. The rest of the team is full of entrepreneurs and other successful folks.

On a personal level, I’ve been working with Chris & his team for months and like them a lot.

Minimum investment

Great

We see a lot of $100 minimum investment opportunities through Reg A offerings. You can test the waters with very little capital. Easy.

Company performance

Not bad

KingsCrowd has never been profitable. This is common with all startups, but that has to change at some point, or its bye-bye company.

KingsCrowd believes its pathway to profitability is through increasing its subscriber base (I agree with this 100%)

Their revenue and subscriber count have been growing rapidly since covid, and the company plans to break even before the end of 2023.

Competition

Leaders

KingsCrowd believes there is no true comprehensive data platform beside them.

They have a lot of what I’d call “tertiary” competition. But not a ton of direct competitors — at least for now.

While some pretty fantastic newsletters offer in-depth analysis (wink wink), they don’t always provide the data-backed due diligence that KingsCrowd offers.

Closing thoughts

KingsCrowd analyzes startups that are fundraising, and now they’re fundraising themselves — both for their company, and their new fund. (Whew, that’s a lot of fundraising!)

But the fact is, they serve an important role in this space. Most startups simply aren’t that great, and the industry desperately needs a way to separate the wheat from the chaff.

Chris Lustrino believes we’ll live in a world where analysts won’t just trade stocks on Wall Street. He envisions a future in which investors and analysts will work full-time within the alternative assets industry. In this world, he believes that KingsCrowd can be a “Bloomberg-like terminal” to help these people do their jobs.

There’s a lot more to come before they get there though.

KingsCrowd have proven they can be successful in Pre-IPO startups. The team has yet to tap into the wider world of alternative asset classes — real estate, collectibles, digital securities. But that’s on the agenda for KingsCrowd as they continue their unique alternative investment journey.

In the meantime, if you love startup crowdfunding and are bullish on companies that help identify the good ones, then invest in KingsCrowd today.

We like these guys a lot

![]()

Alts Disclosures

- KingsCrowd is a current sponsor of Alts; this was a paid deep dive.

- But we probably would have written this review anyways.

- We do not own any shares of KingsCrowd or the Capital Fund I through ALTS 1.

- I am considering investing in KingsCrowd myself.

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of KingsCrowd. KingsCrowd has agreed to offer an unconstrained look at its business & operations. KingsCrowd is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.

Alts Notes

The authors of Alt Assets, Inc. are not finance or tax professionals. They are self-taught accredited investors, sharing information, research, and lessons learned. The published content is unique, based on certain assumptions and market conditions at the time of publishing, and is intended to serve solely as research, not financial advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several, or all of the alternative asset classes that Alt Assets, Inc. publishes content about on its site. Any published articles from Alt Assets, Inc., in which an alternative asset has a “buy”, “pass”, “overvalued” or “undervalued” designation, do not factor into the asset classes that the Fund through its manager ultimately invests in, and thus, any of the Fund’s investments that have positive designations on the Alt Assets, Inc. site are purely coincidental, as the Fund is actively managed and guided by its own investment parameters, as summarized in the relevant private placement memorandum. The newsletter may contain affiliate links, meaning that Alts.co and its associated entities may receive compensation for referring customers to the noted companies.

© 2022 Alt Assets, Inc.